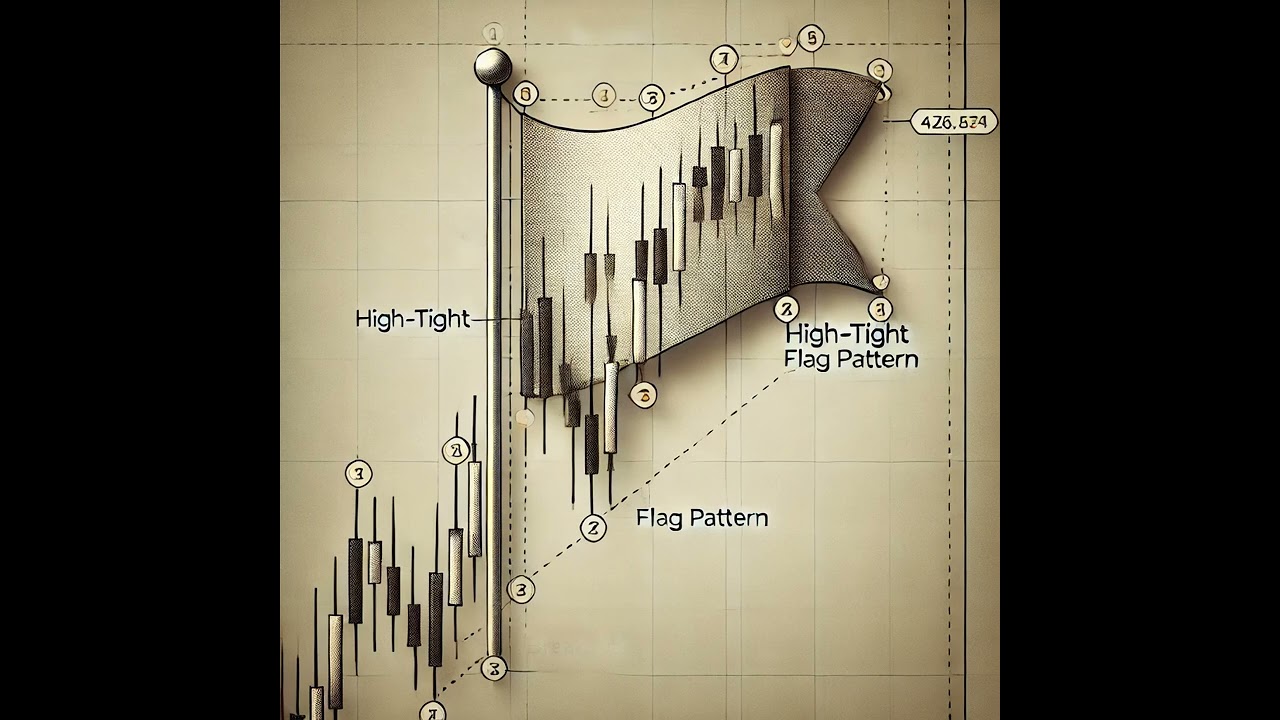

The High Tight Flag (HTF) pattern is a rare but powerful trading setup in technical analysis. This guide provides insights into identifying and trading the HTF pattern effectively, with an emphasis on its characteristics, trading strategies, and potential risks.

Key Characteristics of the HTF Pattern:

1. Sharp Price Increase:

- The HTF pattern begins with a rapid, near-vertical price surge of 100% to 120% or more, typically over eight weeks or longer. This surge is driven by strong buying volume and often follows fundamental catalysts.

- Quote: “This surge typically spans 100% to 120% or more, often over the course of eight weeks or even longer.”

2. Consolidation Phase:

- After the initial surge, the stock enters a consolidation phase lasting 3 to 5 weeks, with a price decline of 10% to 15% (occasionally up to 25%). This controlled pullback shows continued buyer interest, even as short-term sellers take profits.

- Quote: “This consolidation period serves as a ‘breather’ after the aggressive climb, signaling that buyers are still interested…”

3. Breakout:

- Following consolidation, a breakout above the highest point of the consolidation range, with strong volume, signals a potential continuation of the uptrend.

- Quote: “This breakout is a critical signal for traders, as it suggests that buyers are once again pushing the stock higher…”

Trading the HTF Pattern:

1. Wait for Consolidation:

- Exercise patience and allow the stock to enter the consolidation phase after the initial surge. This phase is essential to gauge continued buyer interest.

- Quote: “Patience is essential when trading the HTF pattern…”

2. Look for a Breakout:

- Identify a breakout above the consolidation range with strong volume. This confirms that buyers are likely to continue pushing the stock higher.

- Quote: “Once the stock has completed its consolidation, the next critical step is to wait for a breakout above the highest point…”

3. Set Stop-Losses:

- Implement stop-loss orders slightly below the consolidation range to limit potential losses in case the breakout fails.

- Quote: “Set stop-loss orders slightly below the consolidation range…”

Why the HTF Pattern is Powerful:

- Intense Buying Interest: The initial surge indicates strong demand, potentially attracting institutional investors who could drive further price increases.

- Controlled Pullback: The consolidation phase balances buyers and sellers, reducing the likelihood of a significant reversal.

- Breakout Confirmation: A breakout with strong volume provides confirmation of a resumed uptrend, making this pattern appealing for traders.

Risks and Challenges:

- False Breakouts: Price may initially rise above the consolidation range but then reverse, leading to potential losses.

- Market Conditions: The HTF pattern is more effective in bullish markets; overall market sentiment plays a role in its success.

- Emotional Trading: The pattern’s volatility can trigger emotional responses, requiring disciplined risk management and adherence to trading strategies.

Conclusion:

The High Tight Flag pattern, though rare, offers a potentially lucrative opportunity when identified and traded correctly. Success with the HTF pattern requires understanding its characteristics, waiting for confirmation signals, and implementing effective risk management techniques. This disciplined approach can enhance the chances of capitalizing on this powerful trading setup.

Discover more from Overwise Trend trading

Subscribe to get the latest posts sent to your email.